Income Made Smart LLP transcends the traditional role of a financial advisory firm by serving as a catalyst for empowerment among entrepreneurs, freelancers, and small business owners. Our mission is to equip individuals with the knowledge and strategic insights necessary for effective financial management, fostering a sense of confidence in their financial decisions. Our dedicated team, comprising seasoned professionals with extensive industry experience, is passionate about guiding clients toward financial independence. We believe that with the right tools and guidance, anyone can master their finances and unlock their full potential for success.

The Importance Of Income Made Smart

Why should intelligent income strategies matter to you? The answer lies in their potential to transform your financial landscape, often distinguishing between mere survival and thriving success in today’s fiercely competitive business environment. By grasping the principles behind Income Made Smart management, you can implement innovative strategies that optimize your earnings, reduce unnecessary expenses, and enhance your overall financial stability. This understanding empowers you to navigate challenges more effectively and seize opportunities, ultimately paving the way for sustainable growth and long-term prosperity in your entrepreneurial journey.

Exploring Smart Income Strategies

In this exploration, we will delve into several effective Income Made Smart strategies that are particularly appealing to entrepreneurs, freelancers, and small business owners. These approaches are designed to enhance financial stability and growth, empowering individuals to maximize their earnings while minimizing risks. By adopting these innovative tactics, you can streamline your revenue generation processes, optimize your resource allocation, and ultimately create a more robust financial foundation for your business. Whether you are looking to scale your operations, diversify your Income Made Smart streams, or simply improve your overall financial management, these smart income strategies will provide valuable insights tailored to your unique needs.

Diversification

Diversification involves distributing your Income Made Smart across multiple sources to mitigate financial risk, ensuring that a downturn in one area doesn’t jeopardize your overall earnings. This strategy is particularly beneficial for freelancers, who can expand their offerings by providing various services or collaborating with clients in different sectors. Take the case of Jane, a freelance graphic artist who successfully embraced diversification by creating and teaching online design courses while also selling digital products, such as website themes, on Etsy. This multifaceted approach not only boosted her income but also offered a safety net during slower periods in her freelance work, exemplifying how smart income strategies can lead to greater financial resilience and stability.

Automation

Automation revolutionizes financial management by leveraging technology to streamline essential processes, such as invoicing, bookkeeping, and tax preparation. By automating these tasks, individuals and businesses can save valuable time and minimize errors, freeing up resources to focus on strategic initiatives that foster growth. For instance, Tom, a Income Made Smart business owner, adopted an automated invoicing tool that seamlessly integrated with his accounting software. This decision drastically reduced the administrative burden associated with processing orders and significantly enhanced his cash flow management, illustrating how Income Made Smart strategies can lead to increased efficiency and improved financial health.

Passive Income Streams

Passive Income Made Smart encompasses the revenue generated from investments or business ventures where individuals do not need to be actively engaged. By establishing these income streams, individuals can enjoy financial gains with minimal ongoing effort, allowing them to focus on other priorities while still reaping the benefits of their investments. This can include revenue from rental properties, royalties from intellectual property, and dividends from various investments. By establishing these income streams, you can create a consistent flow of cash that requires minimal ongoing effort once the systems are effectively set up, allowing for greater financial stability and freedom.

Implementing Smart Income Strategies

Implementing innovative Income Made Smart strategies requires a thoughtful approach grounded in careful planning and effective execution. To embark on this journey, start by assessing your current financial situation and identifying areas where improvements can be made. Develop a clear roadmap that outlines your income goals and the specific strategies you intend to implement, whether it be diversifying your Income Made Smart streams, automating processes, or exploring passive income opportunities. Additionally, regularly evaluate your progress and be open to adjusting your plans as needed to adapt to changing circumstances. By taking these proactive steps, you can successfully harness the power of smart income strategies to enhance your financial well-being and achieve long-term success.

Figure Out Your Goals

Having specific objectives in place not only provides direction but also helps you formulate the most effective strategies to achieve them. By establishing these goals, you create a roadmap that keeps you focused and motivated, ensuring that you stay on track as you navigate your financial journey. Whether you aim to save for a significant purchase, invest for retirement, or expand your business, a well-articulated plan will empower you to make informed decisions and measure your progress along the way.

Evaluate Where You Are Now

To effectively implement Income Made Smart strategies, it’s essential to assess your current financial position thoroughly. Begin by reviewing your Income Made Smart sources, expenses, and existing investments to establish a comprehensive baseline. Understanding where you stand financially will provide valuable insights into your spending habits and revenue streams, enabling you to identify areas for improvement. This baseline serves as a critical reference point to measure your progress over time, allowing you to track how well your strategies are working and make necessary adjustments as you work toward your financial goals.

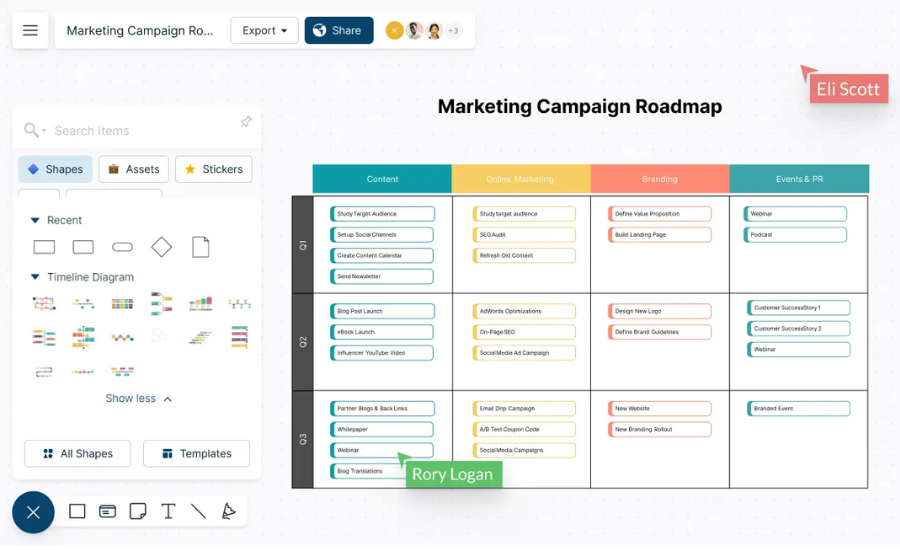

Prepare A Road Map

Craft a detailed plan that clearly outlines the steps required to reach your financial objectives. This plan should specify the actions to be taken, their timelines, and the milestones you aim to achieve along the way. Collaborating with financial experts can greatly enhance the effectiveness of your strategy, ensuring that it is robust and free of potential pitfalls. Their insights and experience will help you refine your approach, providing you with the guidance needed to navigate challenges and stay on track towards achieving your Income Made Smart goals. By taking these proactive steps, you’ll create a solid foundation for financial success.

Utilize Technology

Leverage a variety of digital tools and platforms designed to streamline your financial management processes. Utilizing budgeting applications and Income Made Smart investment platforms can significantly enhance your ability to monitor expenses, manage cash flow, and make informed investment decisions. These tools not only simplify the complexities of finance management but also provide valuable insights into your spending habits and financial health. By integrating technology into your financial strategy, you can save time, reduce errors, and stay organized, ultimately allowing you to focus more on achieving your income goals and less on administrative tasks.

Overcoming Challenges In Implementing Income Made Smart Strategies

Adopting innovative Income Made Smart strategies can be met with various challenges, but with the right approach, you can effectively navigate these obstacles. To overcome common hurdles, start by fostering a growth mindset that embraces adaptability and resilience in the face of setbacks. It’s also essential to prioritize continuous learning; staying informed about market trends and financial best practices will empower you to make smarter decisions. Additionally, consider building a supportive network of mentors and peers who can offer guidance and share their experiences. By proactively addressing challenges and seeking solutions, you can successfully implement smart income strategies that drive your financial success.

Staying Motivated

Staying motivated is crucial, especially during challenging times when your plans may not unfold as expected. To maintain momentum, it’s beneficial to establish Income Made Smart, achievable milestones throughout the year, allowing you to recognize and celebrate your progress. Surrounding yourself with a supportive network of friends, mentors, and like-minded individuals who share your aspirations can provide valuable encouragement and insights. This community not only helps keep you accountable but also inspires you to stay focused on your financial goals. By cultivating this positive environment, you’ll be better equipped to navigate setbacks and remain committed to implementing smart income strategies that lead to lasting success.

Managing Risks

In every financial strategy, risk is an inherent factor that must be managed thoughtfully. To effectively mitigate these risks, diversifying your income sources, conducting thorough research, and keeping abreast of market trends are essential practices. These proactive measures allow you to create a more resilient financial portfolio that can weather uncertainties. Additionally, seeking guidance from financial consultants can provide valuable insights and tailored advice, helping you make informed decisions before committing to any course of action. By combining these strategies, you can enhance your financial stability and confidently pursue your Income Made Smart objectives.

Adapting To Changes

The business landscape is in constant flux, influenced by various factors such as market dynamics, technological advancements, and personal circumstances. This necessitates a readiness to pivot and adjust your Income Made Smart strategies accordingly. Flexibility is not just a desirable trait; it’s essential for navigating the complexities of today’s financial world. By remaining open to change, you can seize new opportunities and address challenges head-on, ensuring that your financial plan stays relevant and effective.

FAQS About Income Made Smart

Q: What does “Income Made Smart” mean?

A: Income Made Smart” refers to the strategic approach to managing and increasing your income through intelligent financial planning. It encompasses various tactics such as diversifying income streams, automating financial processes, and leveraging passive income opportunities to enhance financial stability and growth.

Q: Who can benefit fromIncome Made Smart strategies?

A: Entrepreneurs, freelancers, and small business owners can all benefit from smart income strategies.

Q: How can I start implementingIncome Made Smart strategies?

A: To begin implementing Income Made Smart strategies, start by assessing your current financial situation and identifying your goals.

Q: What are some examples of passive income?

A: Passive Income Made Smart can come from various sources, including rental income from real estate, royalties from creative works, dividends from stocks, or earnings from online courses.

Q: Why is financial diversification important?

A: Financial diversification is crucial because it spreads risk across different Income Made Smart sources.

Q: How can automation improve my financial management?

A: Automation simplifies financial management by using technology to handle tasks like invoicing, bookkeeping, and tax preparation.

Conclusion

At Income Made Smart LLP, we are committed to empowering entrepreneurs, freelancers, and small business owners on their journey to financial independence through the implementation of intelligent Income Made Smart strategies. By diversifying revenue streams, automating key processes, and exploring passive income opportunities, you can maximize your earnings while minimizing financial stress. We invite you to join our community, where we share insights and support each other in making informed financial decisions.

Stay connected for exclusive updates and alerts! Article Forward